What is Source of Funds (SoF) in Crypto Real Estate?

Source of Funds (SoF) is the legal, tax, and forensic verification process used in Spain to prove the exact origin, traceability, and legitimacy of the cryptocurrency used in a property transaction, ensuring compliance with anti-money laundering (AML), counter-terrorist financing (CTF), and tax regulations before a notary can authorize the deed.

Source of Funds (SoF) vs Source of Wealth (SoW)

| Concept | Meaning | Who Requires It | Purpose |

|---|---|---|---|

| Source of Funds (SoF) | Where the exact crypto used in the purchase comes from | Notaries, banks, SEPBLAC | Prevent money laundering and illicit funds entering real estate |

| Source of Wealth (SoW) | How the buyer originally generated their overall wealth | Tax authorities, banks | Prevent tax evasion and unexplained enrichment |

| Blockchain Traceability | Transaction history and wallet lineage | Compliance officers | Identify exposure to illicit sources |

| Fiscal Justification | Tax declarations and accounting records | Hacienda (Agencia Tributaria) | Ensure capital gains and income are properly declared |

1. Why Source of Funds Is the Main Obstacle in Crypto Property Transactions

In Spain, the use of cryptocurrency to purchase real estate is legally possible, but practically complex. The primary reason is not technological; it is regulatory. Under Spanish and European anti-money laundering law, real estate transactions are classified as high-risk operations. When cryptocurrency is involved, that risk classification increases significantly.

More than half of attempted crypto-funded property purchases in Spain face one of the following outcomes:

- Delay of several months due to compliance reviews

- Temporary freezing of funds by banks

- Refusal by the notary to authorize the public deed (escritura pública)

- Reporting to SEPBLAC (Spain’s Financial Intelligence Unit)

- Initiation of a tax audit by Agencia Tributaria

All of these problems originate from one core issue: insufficient or inadequate Source of Funds documentation.

From a legal perspective, it is not enough to say, “This is my Bitcoin” or “I bought it years ago.” Spanish law requires proof that:

- The funds are traceable on-chain

- The funds are not linked to criminal activity

- The funds are fiscally regularized

- The beneficial owner is clearly identified

- The transaction complies with EU AML Directives

Without this, the operation can be blocked regardless of the buyer’s net worth.

2. The Legal Framework Governing Crypto Source of Funds in Spain

Source of Funds verification in Spain is governed by a multi-layered regulatory structure:

- EU Fifth Anti-Money Laundering Directive (5AMLD)

- EU Sixth Anti-Money Laundering Directive (6AMLD)

- Spanish Law 10/2010 on the Prevention of Money Laundering

- Royal Decree 304/2014

- SEPBLAC compliance guidelines

- EU Travel Rule (Regulation 2023/1113)

- Notarial AML obligations

Under these rules, notaries are not mere witnesses. They are legally designated “obliged entities” (sujetos obligados). This means they must:

- Perform KYC on all parties

- Identify the beneficial owner

- Analyze the economic substance of the transaction

- Verify the origin of funds

- Refuse authorization if doubts remain

- Report suspicious activity to SEPBLAC

Failure by a notary to perform proper Source of Funds checks exposes them to severe administrative and criminal liability. As a result, the standard of proof applied to crypto transactions is extremely high.

3. Why Cryptocurrency Triggers Enhanced Due Diligence (EDD)

Cryptocurrency is classified as a high-risk asset class under AML regulations for several reasons:

- Pseudonymity of wallets

- Cross-border nature of transactions

- Exposure to mixers, tumblers and privacy protocols

- Use in darknet markets and ransomware

- Sanctions evasion risks

- Rapid price volatility affecting tax treatment

Therefore, when crypto is used in a real estate purchase, Enhanced Due Diligence (EDD) is mandatory. This includes:

- Blockchain forensic analysis

- Risk scoring of all wallets involved

- Identification of transaction counterparties

- Screening against sanctions lists

- Assessment of exposure to illicit services

- Correlation with declared tax position

A simple exchange statement or a screenshot of a wallet balance is not sufficient. What is required is institutional-grade forensic documentation.

4. Source of Funds vs Source of Wealth: A Critical Distinction

Many investors confuse Source of Funds with Source of Wealth. Legally, they are distinct:

- Source of Funds answers: “Where does this specific Bitcoin come from?”

- Source of Wealth answers: “How did you make the money that allowed you to acquire this Bitcoin in the first place?”

Example:

An investor buys 100 BTC in 2016 using profits from a software company.

In 2025, he sells 10 BTC to buy a villa in Spain.

For the notary and the bank:

- SoF: Trace the 10 BTC from current wallet back through all transactions to their original acquisition.

- SoW: Demonstrate that the original capital used in 2016 was generated legally and declared for tax purposes.

If either element is missing, the transaction can be classified as suspicious, even if the blockchain trail is perfectly clean.

5. The Role of Blockchain Forensics in Notarial Approval

Professional Source of Funds verification relies on blockchain analytics platforms such as:

- Chainalysis

- TRM Labs

- Crystal Blockchain

These tools perform:

- Transaction graph analysis

- Wallet clustering

- Exposure analysis to illicit entities

- Risk scoring based on typologies

- Temporal transaction mapping

- Cross-chain tracing

A proper SoF report typically includes:

- Identification of all input wallets

- Full transaction lineage

- Percentage exposure to high-risk services

- Sanctions screening

- Attribution to regulated exchanges

- Confirmation of clean exit to fiat or stablecoins

- Risk classification: low, medium, high

For Spanish notaries and banks, these reports provide the objective, third-party evidence required to justify authorization of the deed and acceptance of funds.

6. The Banking Layer: De-Risking and Account Freezes

Even if the seller accepts crypto directly, most transactions still involve a banking component:

- Escrow

- Partial fiat settlement

- Tax payments

- Mortgage cancellation

- Capital gains settlement

Spanish banks apply their own AML policies, often stricter than statutory minimums. Common triggers for de-risking include:

- Incoming funds from unhosted wallets

- Interaction with high-risk exchanges

- Previous use of mixing services

- Inconsistent transaction patterns

- Lack of economic rationale

If the Source of Funds file is incomplete, banks may:

- Freeze the account

- Request additional documentation

- File a suspicious activity report

- Terminate the client relationship

This is why SoF must be prepared before funds are moved, not after.

7. The Notary’s Perspective: Why Transactions Are Blocked

From the notary’s standpoint, a crypto real estate deal must satisfy three cumulative tests:

- Legal traceability (blockchain and KYC)

- Economic coherence (does the transaction make sense financially?)

- Fiscal consistency (are taxes properly declared and paid?)

If any of these fail, the notary is legally obliged to:

- Suspend the signing

- Request further evidence

- Inform compliance bodies

- In extreme cases, refuse the operation

This is the “fear of blocking” that most high-net-worth crypto investors face: the risk that, despite having the funds, the transaction collapses at the last legal step.

8. Tax Risk and “Fear of Hacienda”: How SoF Protects You From Audits

One of the main fears of crypto investors buying property in Spain is not the notary — it is the Spanish Tax Agency (Agencia Tributaria).

From a tax perspective, a crypto real estate purchase automatically triggers several red flags:

- Large capital movements

- Cross-border funds

- High-value asset acquisition

- Potential undeclared capital gains

- Possible mismatch between lifestyle and declared income

Source of Funds documentation acts as a legal firewall by proving:

- When and how the crypto was acquired

- At what value

- Whether capital gains were declared

- Whether wealth tax, income tax or corporate tax applies

- That no hidden income exists

Without this, Hacienda can open:

- Capital gains inspections

- Unjustified wealth investigations

- Anti-money laundering referrals

- International tax information exchange procedures

A compliant SoF file links blockchain history with tax history, closing the loop between on-chain reality and off-chain fiscal obligations.

9. The Land Registry and Long-Term Legal Security

Even if a deed is signed, the operation is not legally finished until registration in the Spanish Land Registry (Registro de la Propiedad).

If the registrar detects:

- Inconsistencies in payment origin

- Suspicious financial structures

- Incomplete AML documentation

The inscription can be delayed or conditioned. A robust SoF report ensures:

- Clean title registration

- No future challenges

- No annotation of suspicious activity

- Full legal certainty for resale or inheritance

10. Why Generic Exchange Statements Are Not Enough

Many buyers attempt to justify funds with:

- Exchange screenshots

- Account statements

- Wallet balances

These documents fail because they do not:

- Prove historical origin

- Show full transaction lineage

- Detect indirect exposure to illicit sources

- Provide risk scoring

- Meet institutional AML standards

Only blockchain forensic reports combined with legal and tax analysis are accepted at professional level.

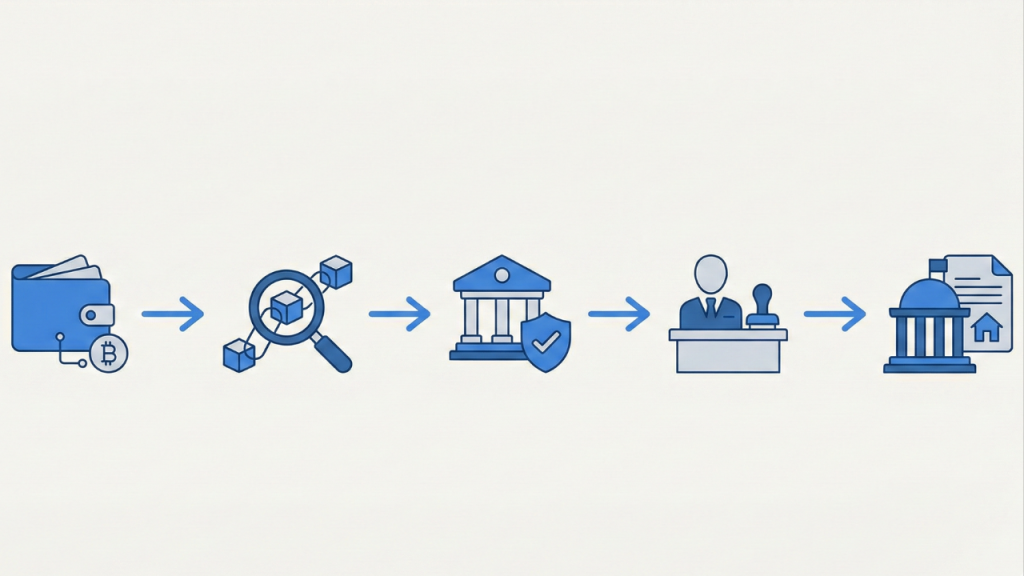

Step-by-Step: How to Verify Source of Funds for a Crypto Real Estate Purchase in Spain

- Identify the funding wallet(s)

- Perform blockchain forensic analysis (Chainalysis / TRM / Crystal)

- Generate risk scoring and exposure report

- Trace funds back to original acquisition

- Reconcile with tax declarations

- Prepare legal SoF & SoW dossier

- Pre-clear with notary and bank compliance

- Execute transfer or escrow

- Sign deed

- Register property with clean compliance record

Avoid Notary Blocking & Tax Investigations When Buying Property With Crypto

Verify your Source of Funds with institutional-grade blockchain forensics and legal compliance before signing.

Get Your Crypto Compliance ReviewFAQs

Can a notary refuse to sign if my crypto comes from DeFi?

Yes, if the DeFi protocol or wallet history cannot be fully traced and risk-scored under AML standards.

Is a Chainalysis report mandatory in Spain?

Not legally mandatory, but increasingly required by banks and notaries as objective forensic evidence.

Will Source of Funds protect me from Hacienda audits?

A proper SoF and SoW file significantly reduces audit risk by proving fiscal regularity and legal origin.

Can my operation be blocked after signing?

Yes, at Land Registry or banking level if compliance documentation is insufficient.

Related Articles – Deepen Your Expertise

- Real Estate Authority: Buy Property in Spain with Crypto: The Comprehensive 2026 Guide

- Fiscal Strategy: Spain Crypto Real Estate Taxes Explained (For Foreigners)

- Efficiency & Speed: Crypto Real Estate Speed: Buying Faster than Banks (2026 Edge)